Economic outlook 2024:

a tale of two halves

Economic outlook 2024: a tale of two halves

Peter Munckton

Chief Economist

This year, the economy will be a tale of two halves. The factors that kept the economy sub-par in the second half of 2023 are still prevalent as we enter 2024. Growth in disposable income (after taking into account inflation) will still be weak. Interest rates are unlikely to be heading up; however, nor will they be coming down.

Population growth will almost certainly be lower this year. The global economy looks like it is taking a (modest) step down. Residential construction activity could be weaker.

But for all the gloom there are good reasons to think that the economy is likely to end the year in a better state than it started.

- Fiscal policy is more supportive of the economy this financial year (and even more so in 2024-25).

- Interest rates look like they will be reduced in developed economies this year. The Chinese Government is likely to provide further fiscal and monetary support to its economy.

- Lower inflation and tax cuts will mean that real household disposable income growth will turn positive in the second half of this year.

- There is a large amount of building and engineering work still in the pipeline (roads, rail, green transition). El Nino has not been as bad as feared (although partly offset by the severe flooding in some regions).

My expectation is the economy will be better in the second half of the year, but still not good enough. It is possible that if we get higher house and equity prices, a still-strong jobs market, and the potential for some catch-up spending, the economy could be in a better state than what I am projecting. This would be even more likely if interest rates are cut earlier, or fiscal policy is more supportive than I expect.

The big negative risk is the global economy. The European economy is verging on recession. The Chinese Government provided economic support in 2023 without any notable pickup of activity. The even bigger risk though is if fiscal and monetary policy support is more limited than I expect. The most likely reason would be if inflation stayed too high.

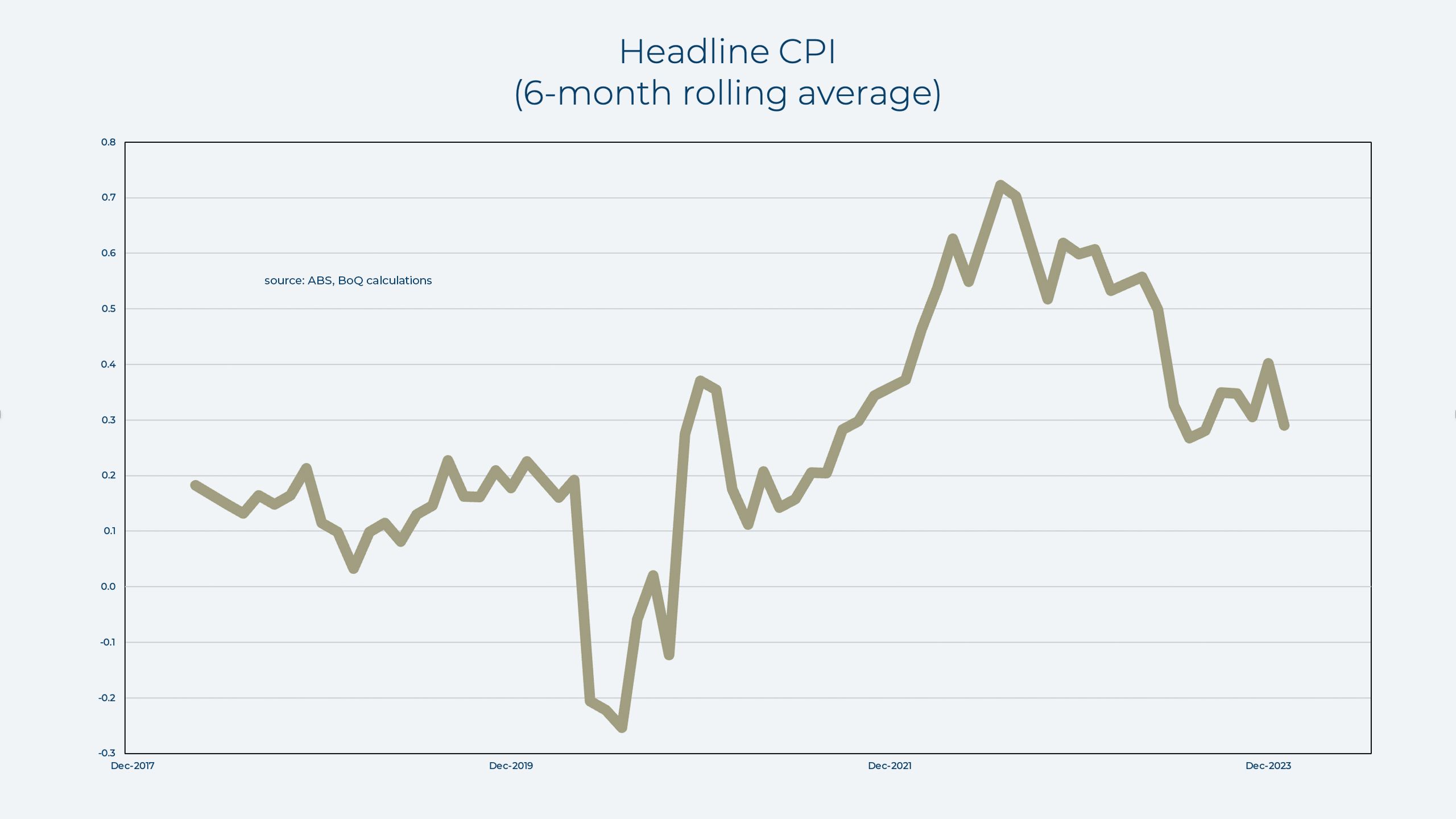

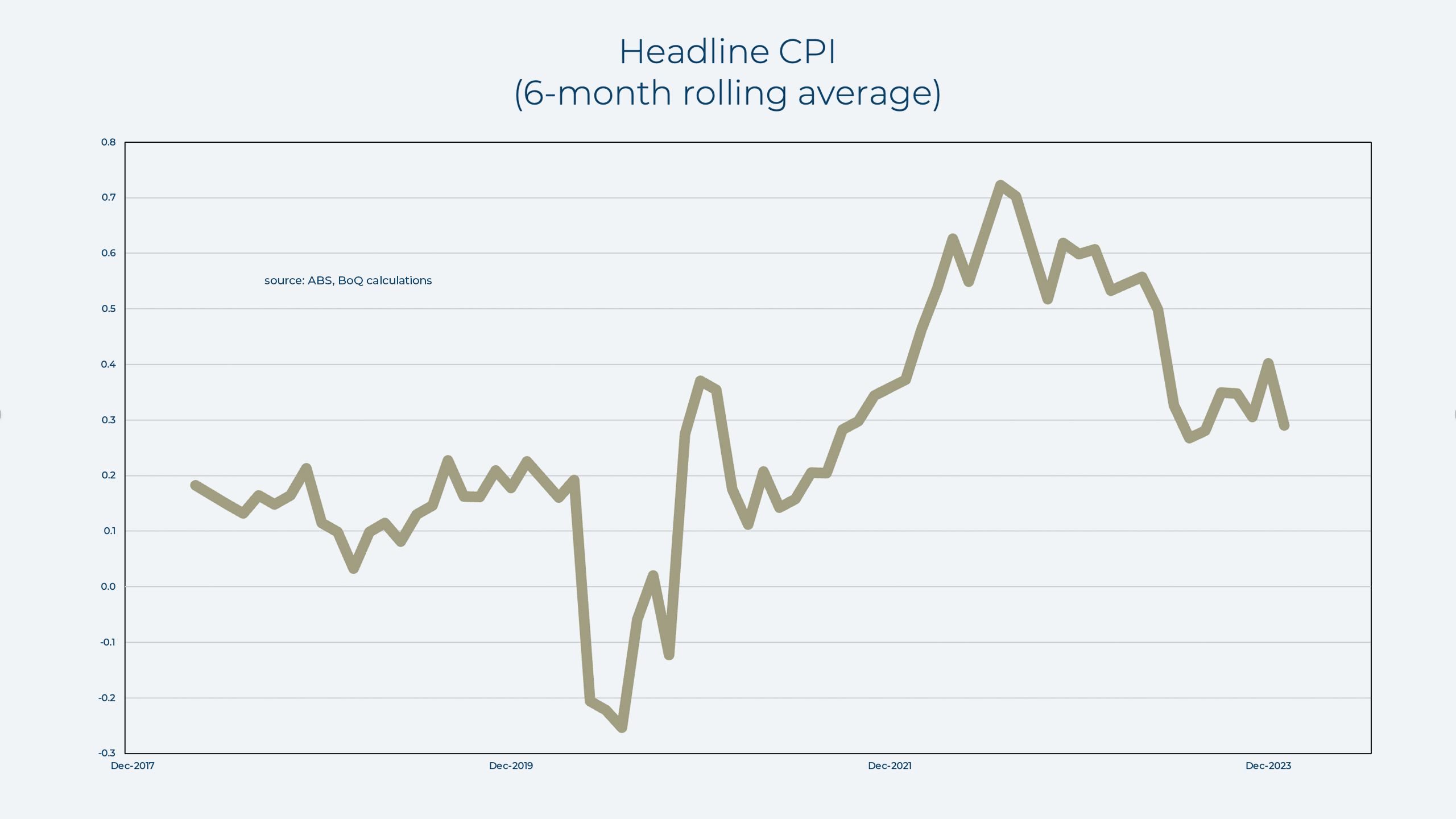

Inflation declined sharply in 2023. Demand slowed given the crunch to household disposable incomes and the end of revenge spending. Supply has risen, reflecting improved worker availability and the end to global supply-chain snarls (despite the recent problems in the Red Sea).

These factors are still providing a downward push to inflation. Lower oil and gas prices will help, and it looks like there will be no more big rises in electricity prices. The increasing worry of affordability means rent growth will probably be lower. But growth in some service sector prices such as insurance are still too high, causing central banks to worry about inflation ‘stickiness’. The most likely outcome is for inflation to continue its decline, just not as quickly as it has done over the past year.

‘The most likely outcome is for inflation to continue its decline, just not as quickly as it has done over the past year.’

‘The most likely outcome is for inflation to continue its decline, just not as quickly as it has done over the past year.’

Disclaimer

The information contained in this article is general and has been provided in good faith. This information has been prepared without taking account of your objectives, financial situation, or needs. Whilst all reasonable care has been taken to ensure that the information is accurate and opinions fair and reasonable, BOQ Specialist makes no representations or warranties. BOQ Specialist recommends that you obtain independent financial and tax advice before making any decisions. The opinions expressed in this article are those of the author and do not necessarily reflect the opinions of BOQ Specialist.BOQ Specialist is not offering financial, tax or legal advice. You should obtain independent financial, tax and legal advice as appropriate.